The twentieth century undertaking doesn’t oversee business reality! Business the truth is characterized by two elements:

– Results: The particular financial results from the entirety of the business

– Execution Solutions: The contributed capital explicitly used to create explicit outcomes

The venture should put together and oversee results and execution arrangements to coordinate and oversee business reality.

The disappointment of the twentieth century endeavor to put together and oversee business reality makes unsolvable administration, business, and execution issues. The twentieth century endeavor characterizes both the presentation arrangements used and the outcomes created as execution. This imperfect definition forestalls the executives of business reality. Thus, all things considered, we think up different strategies as overlays on the business and oversee substances like divisions, occupations, positions, capacities, and cycles.

We keep on overlaying new techniques and compose huge number of books, however we have never tackled the best 10 administration issues in the twentieth century endeavor.

1. Rearrangements:

We have never coordinated the business. All things being equal, we arrange individuals, positions, power, and legislative issues and overlay unbending thought up association structures on the business. The business should acclimate to the association. Business change makes it more hard to change, until there is a significant disturbance called the revamping. We then, at that point, imagine another self-assertive association and rehash the cycle.

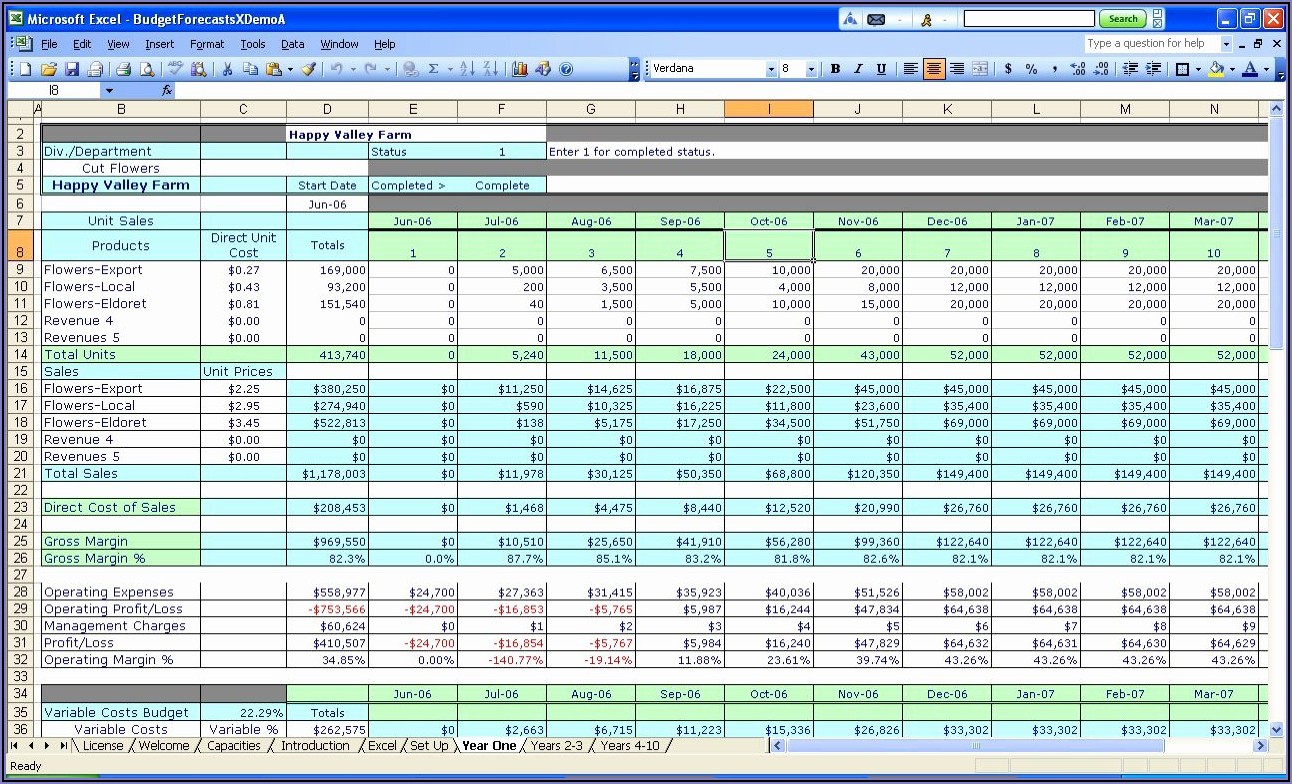

2. Bookkeeping and Financial Management:

By and large, the undertaking expected to secure money thus set up money and gathering bookkeeping and monetary administration. Bookkeeping and monetary administration hold this heritage and, thus, forestall current records the executives and thorough capital administration. Bookkeeping forestalls monetary records on costs, esteem made, and thorough capital worth. Monetary administration focuses on simple to-oversee cash and monetary ventures and forestalls the board of high-worth capital that is “regulated” or is marked as “theoretical resources”.

3. Speculation Analysis and Capital Development:

The endeavor can’t order and plan the advantages of capital advancement speculations, and can’t oversee improvement of advantages and profit from ventures. Venture benefits are imagined gauges that can’t be made due. There is no administration obligation regarding the usage of created execution arrangements, to guarantee the return.

4. Organization:

Organization fills roles, rather than creating results, and forestalls appropriate capital administration. The undertaking puts resources into capital that winds up being regulated, rather than oversaw for advantageous usage, proceeding with progress, and an exceptional yield on the venture.

5. Execution Management:

Execution is characterized to incorporate the activities of performing, yet in addition the outcomes created. This implies that exhibition and the outcomes delivered are combined as one as key execution pointers and in the different presentation the board strategies utilized. This meaning of execution keeps the twentieth century endeavor from overseeing business reality.

6. Business Complexity:

Each new strategy, re-designed cycle, executed framework, diagram of records, and so on is an overlay on the business and adds to business intricacy. Imagined elements are overseen forestalling comprehension of business reality. New outcomes and execution are added yet are not overseen as a venture entire, for development or evacuation when not required.

7. Data Technology:

Data frameworks and arrangements are overseen as innovation. IT covers system, arranging, business application, innovation, and engineering the board. This forestalls one coordinated endeavor methodology and incorporated business capital and backing. The assorted capital requires numerous capacities to make due, making the CIO issue. Applications are overseen as innovation rather than as business arrangements, and business change winds up in the specialized accumulation.

8. Change Management:

We want change the board since we botch change. We don’t deal with the business, human, and the board money to be changed and used for benefit. Change is through problematic ventures, rather than as business as usual. Change the board administrations address manifestations and don’t take care of principal issues.

9. Corporate Governance:

We attempt to take care of corporate administration issues from the administration side by reinforcing the issues in bookkeeping, examining, and consistence revealing. This is vain. The issue must be killed from the corporate side, by getting sorted out and overseeing business reality.

10. Arrangement:

Numerous techniques have been created and many books have been composed on adjusting methodology to the business, data frameworks with the business interaction, rethought processes and inward cycles, substantial resources and theoretical resources, and so on This additionally is pointless. We can’t adjust answers for arrangements. We can adjust answers for their feedback and result results.