Settling on a choice to make and screen a financial plan is a significant expertise for any money manager. Spending plan choices can be an every day task that can keep your business on target and in the benefit path. The following are 7 simple to utilize steps that tell you the best way to start working with your business as a finance manager.

Stage 1.

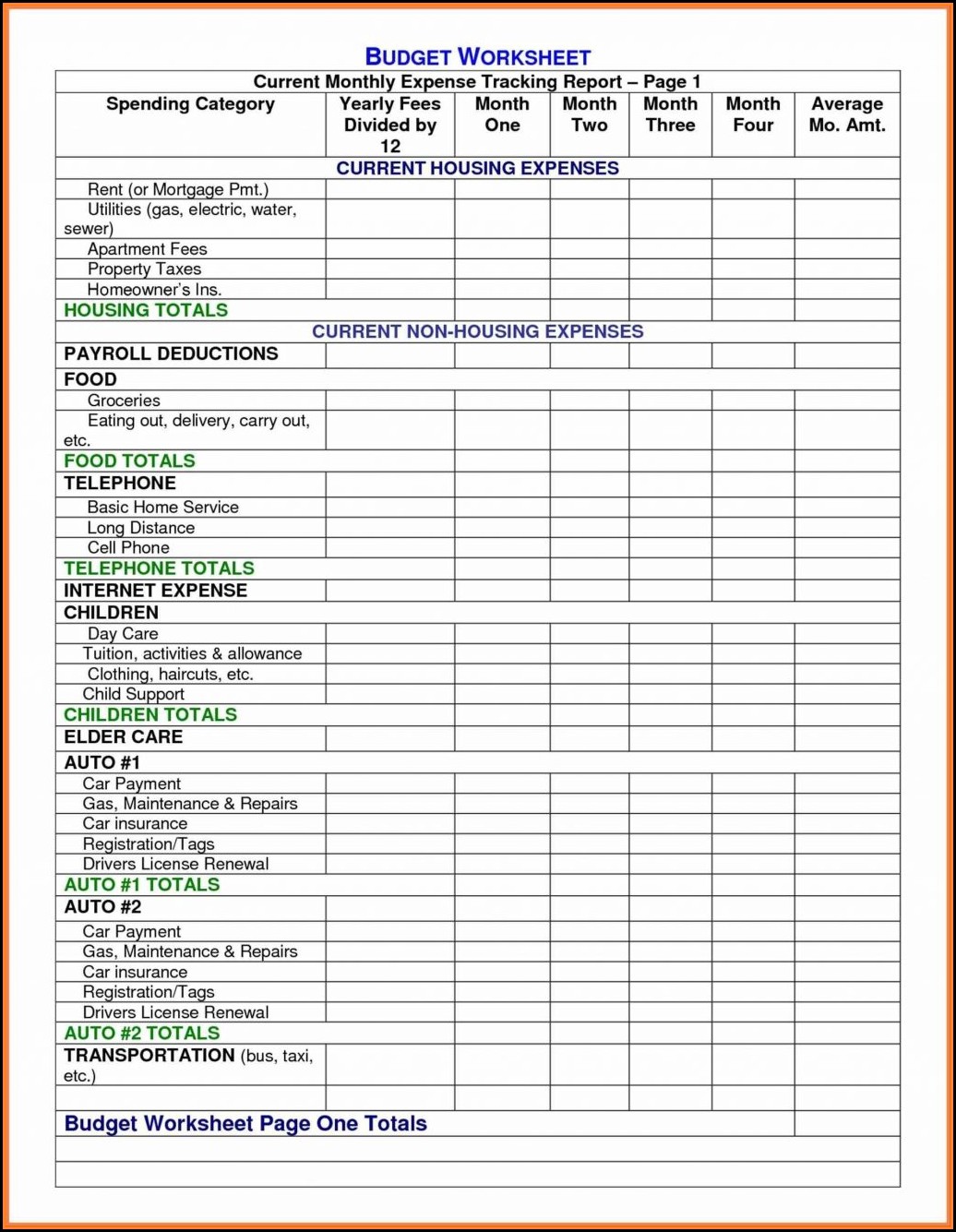

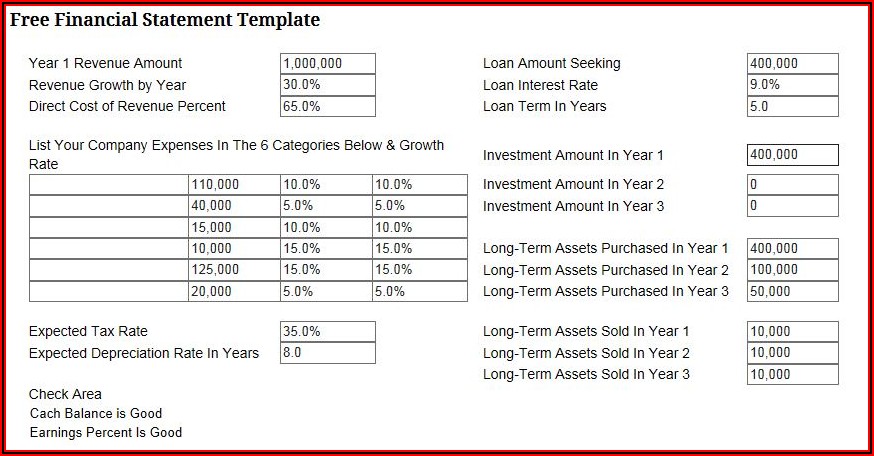

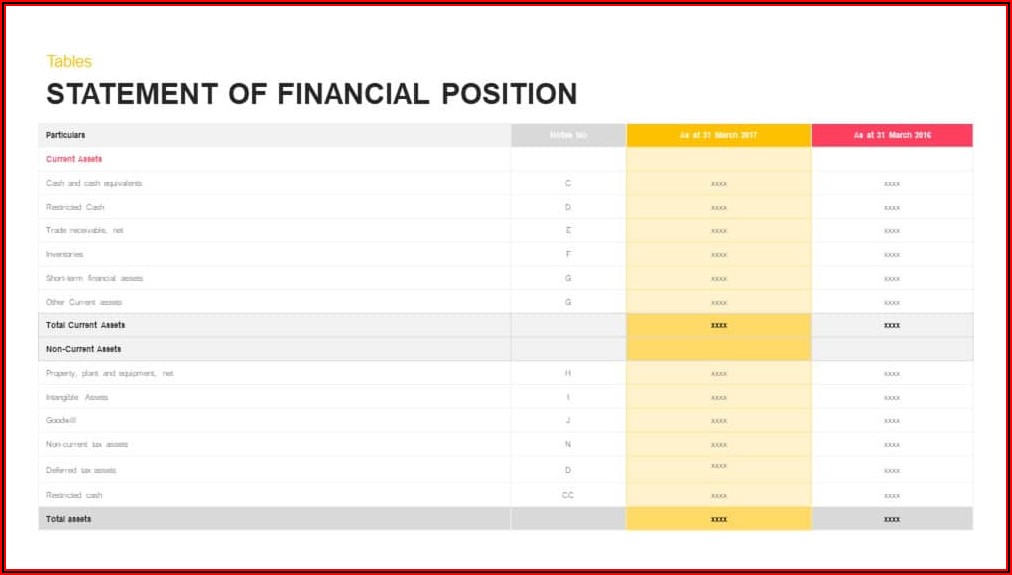

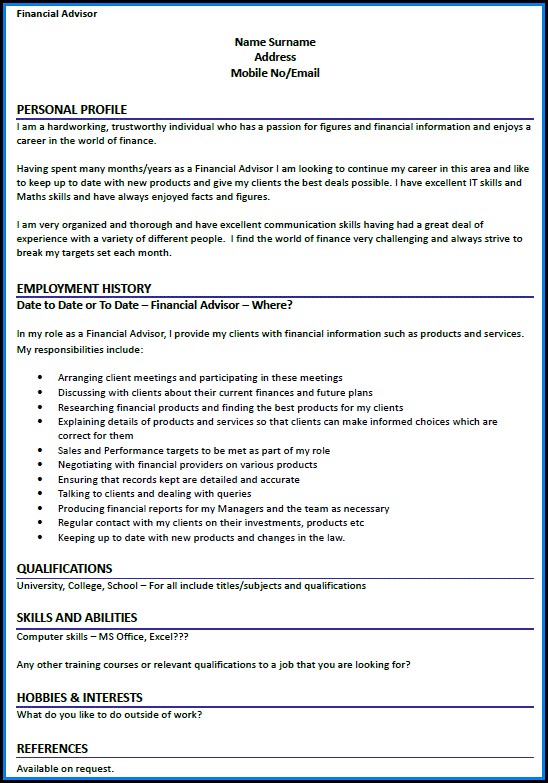

Rundown the thing and monitor the costs in your business. Incorporate merchants you will utilize, representatives and sub-project workers. This will make your graph of records when you set up your accounting framework. You will add or deduct from this diagram as you get your business ready for action. Save a running absolute for every week then, at that point, add the sums for the month.

Stage 2.

Presently make a rundown and monitor all spaces of pay in your business. You need to know the types of revenue and which spaces of the business are your best cash creators. Keep track every week and afterward include the pay sums for the month.

Stage 3.

Compute how much cash you really made every month. Do this by taking the absolute of your pay and deducting the genuine sum went through (for that month). You need to know the distinction between what you got and what was spent to let you know the benefit or misfortune for the month.

Stage 4.

Watch out for the sums left over every week in your classifications on your diagram of records. That is finished by taking note of the sums in the records contrasted and the uses for every class toward the week’s end or month. A negative equilibrium demonstrates you are losing cash in that classification. A positive equilibrium implies you have cash left over in any class. This is your excess for that classification.

Stage 5.

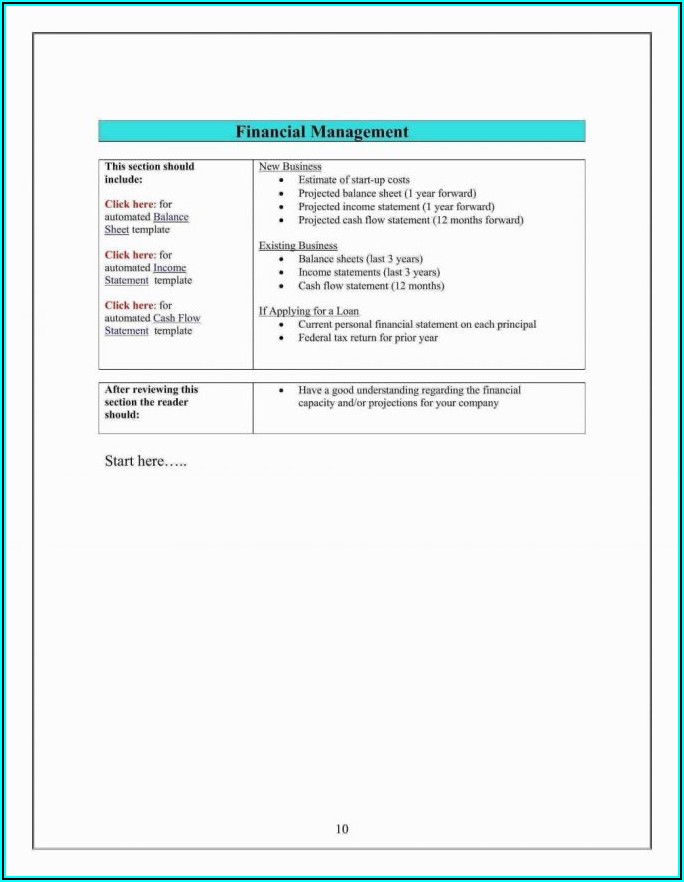

Keep on evaluating your financial plan consistently and to some extent one time each week. You need to monitor the cash stream all through your business. It will require somewhere around a year and perhaps as long as three years to comprehend your spending cycles and have the option to do truly monetary investigation in your business.

Stage 6.

Break down monetary outcomes consistently. Assuming you routinely track down an excess sum on a cost class, examine the reason why this is. Be cautious with regards to making suppositions about excesses or enormous uses per every class. There might have been conditions to get this going, for example, it being a brief time frame, decline in the expenses in that class or another factor. The following month may be unique so you need to hold on to track down a normal.

Stage 7.

Rearrange classifications as doable. Subsequent to doing the investigation in sync 6, you should correct a portion of the spending plan classes by placing more cash in certain classifications that are straightforwardly assisting the business with developing and removing some from classifications that don’t require as much financing.

These seven stages will assist you with having a better monetary start for your business. As you work with spending plan choices as a money manager you will actually want to all the more likely expect your monetary requirements in the business. Learning the numbers will be the premise of your achievement in your business administration capacities.