Most organisations are trying to cut their spending in the current economic climate. There are many steps that any business can take to reduce their expenditures in the short- to medium-term. Here are ten options.

1. Telecoms

There’s a lot of competition in the telecoms market, which means there’s plenty to choose from for your business. If you are with a big brand provider, you can save up to 10% on your line rental and more often on call charges. Compare like-for-like rates and take into account the length of your contract.

2. Printing

You should get rid of your desktop printers. Multifunctional devices (MFDs) can be used to photocopy, scan and print, as well as fax. You will see a reduction in hardware costs and lower running costs if you sign a CPC contract (cost per copy), rather than spending on maintenance and consumables.

3. Office Stationery

Your suppliers and invoices can be consolidated. Your negotiating power will be increased by buying from one source. Using a buying group will further increase this. You should monitor your usage and limit the amount of people with the authority to order stock. Savings up to 25% can be made by using your own brand products

4. Utilities

Many businesses don’t compare their electricity and gas providers, and they are missing huge savings. A broker will allow you to get a wider selection of tariffs. You should inform your suppliers when you are still under contract. Many will offer a small window of time before you can move on to a long-term deal.

5. Go Green

You can set the default printing function to print on both the sides and mono on all of your office computers. This is a great way to reduce office paper costs. You can also avoid having to pay for colour copies which are often 10 times more expensive than Black & White. It is a good idea to turn off all monitors, lights, and other electrical devices that are not being used. This will save you money and help the environment.

6. Outsourcing

It is possible to save significant money by outsourcing non-critical functions. The main areas under review are IT, Finance, and HR. However, depending on your industry, you might be considering outsourcing manufacturing, distribution, or customer service.

7. Banking

Be aware of your bank fees! These aren’t fixed and banks can profit in many areas from your business. What interest rates are being charged on your credit accounts? There are many online services offered by banks. Paying a higher monthly fee could mean a lower overall cost due to reduced transaction fees.

8. Business rates

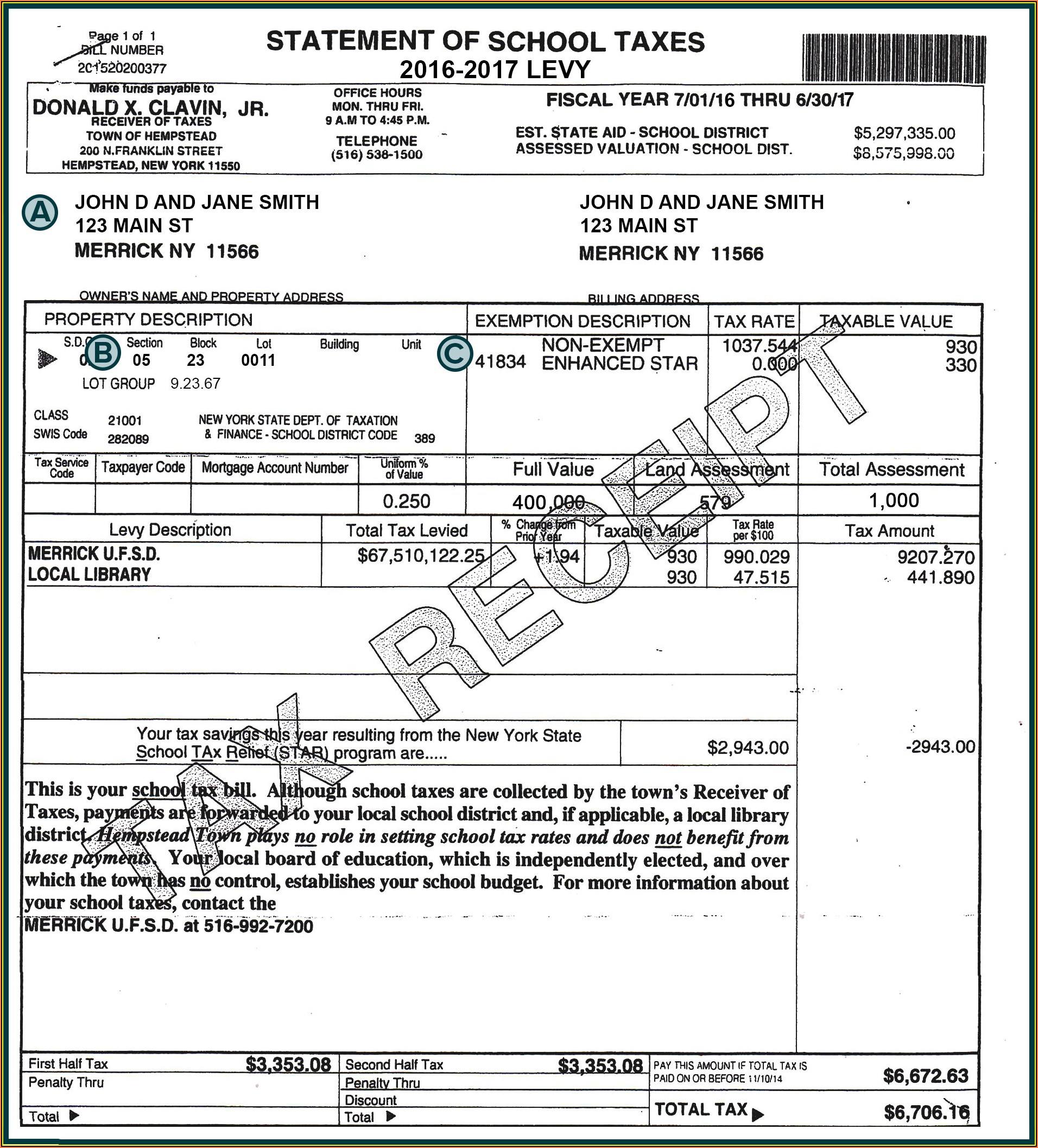

You can challenge your business rates every five years. You don’t have to assume that rates will not change. You can challenge them yourself or hire specialist consultants. You should ensure that a consultant is not charged an upfront fee, and that the charges only reflect any savings made.

9. Capital Allowances

On 95% of UK commercial premises, the capital allowance tax relief businesses have right to has not been claimed. Imagine this: literally millions of pounds are still unclaimed. Anyone buying or building commercial properties can benefit from capital allowances. These allowances can be claimed by businesses. You can deduct a portion of your taxable profits to reduce your tax bill.

10. Fixed Cellular Terminals

FCT’s can be described as a mobile device that connects fixed telephony devices like PBX Telephone System to the GSM Mobile Phone Network. This device can be used to make calls to other mobile users at lower rates, depending on available tariffs, or for remote offices that do not have fixed line service (e.g. Building site/remote monitoring post. FCT’s offer the possibility of reducing the charges by around 3ppm in an age when mobile and landline calls are increasing dramatically for businesses. This is a huge saving compared to the competitive fixed line costs of about 7-8ppm currently on the market.